It’s no secret that investing in real estate can be a very lucrative addition to your portfolio. It seems that everyone now is trying to find their next real estate piece of gold to flip, rent, or turn into an Airbnb. If you’re seeking a new real estate investment option with the potential for a significant ROI, it’s time to shift your search from looking for gold to looking for green– green zoning that is. Smart investors are identifying the huge potential in the US cannabis market, making green zoned cannabis properties an investment opportunity worth exploring.

With that said, there is a certain level of savvy it takes to dive into an emerging industry, particularly one like cannabis that is constantly changing and highly regulated. It’s not like riding a bike. It’s more like sitting in the cockpit of a stunt plane. You need to know what you are doing (or have a cannabis consultant to help steer you in the right direction), otherwise it’s going to be a very precarious ride.

But for those trailblazer-type real estate investors who seek alternative investments and want to be in on the next big thing before it’s a thing, cannabis real estate may be just the right option to diversify and grow your portfolio. Cannabis investing is more than just becoming a marijuana grower or dispensary owner. Here are a few alternate real estate investment vehicles to help you see green in more ways than one.

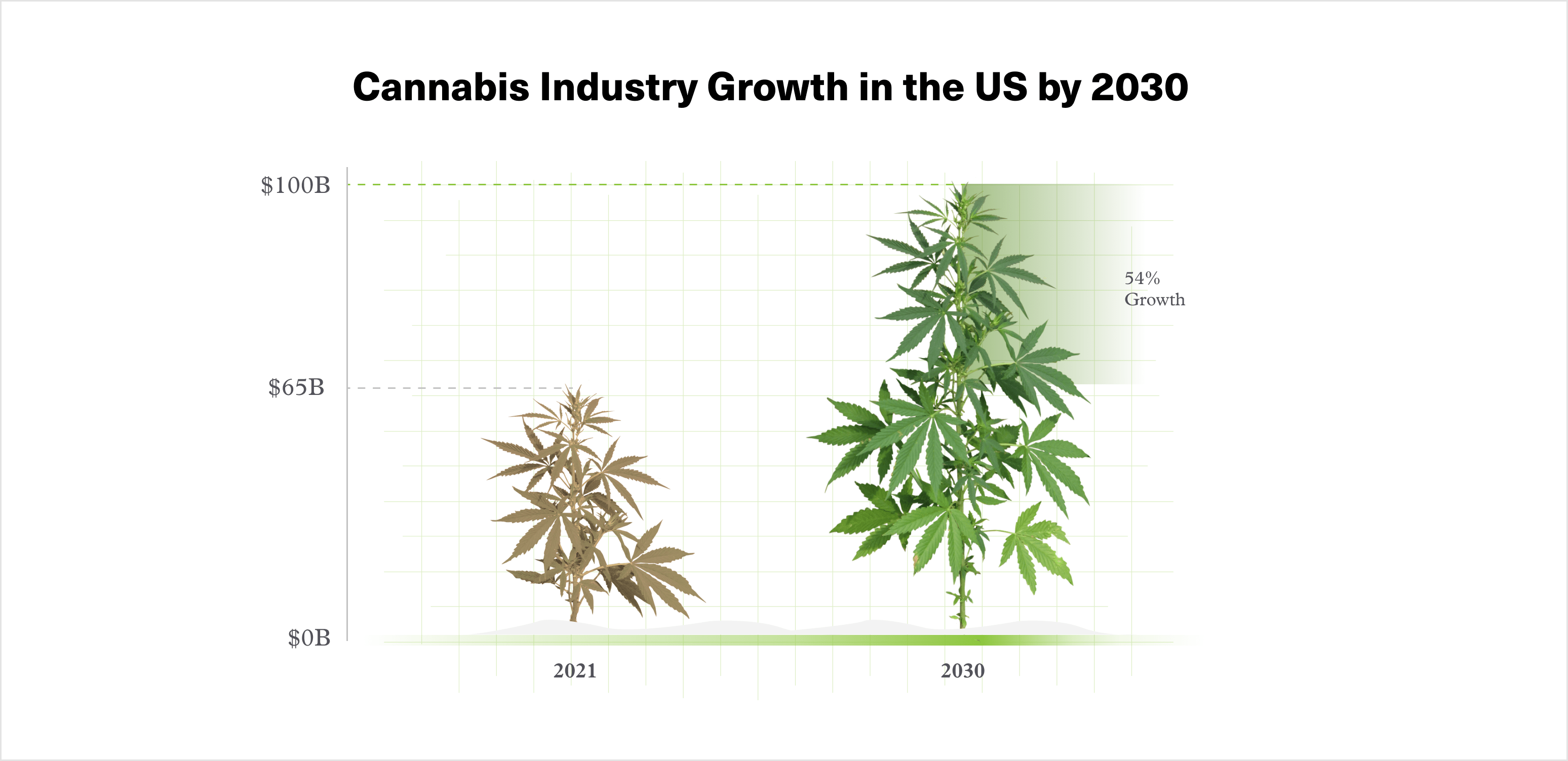

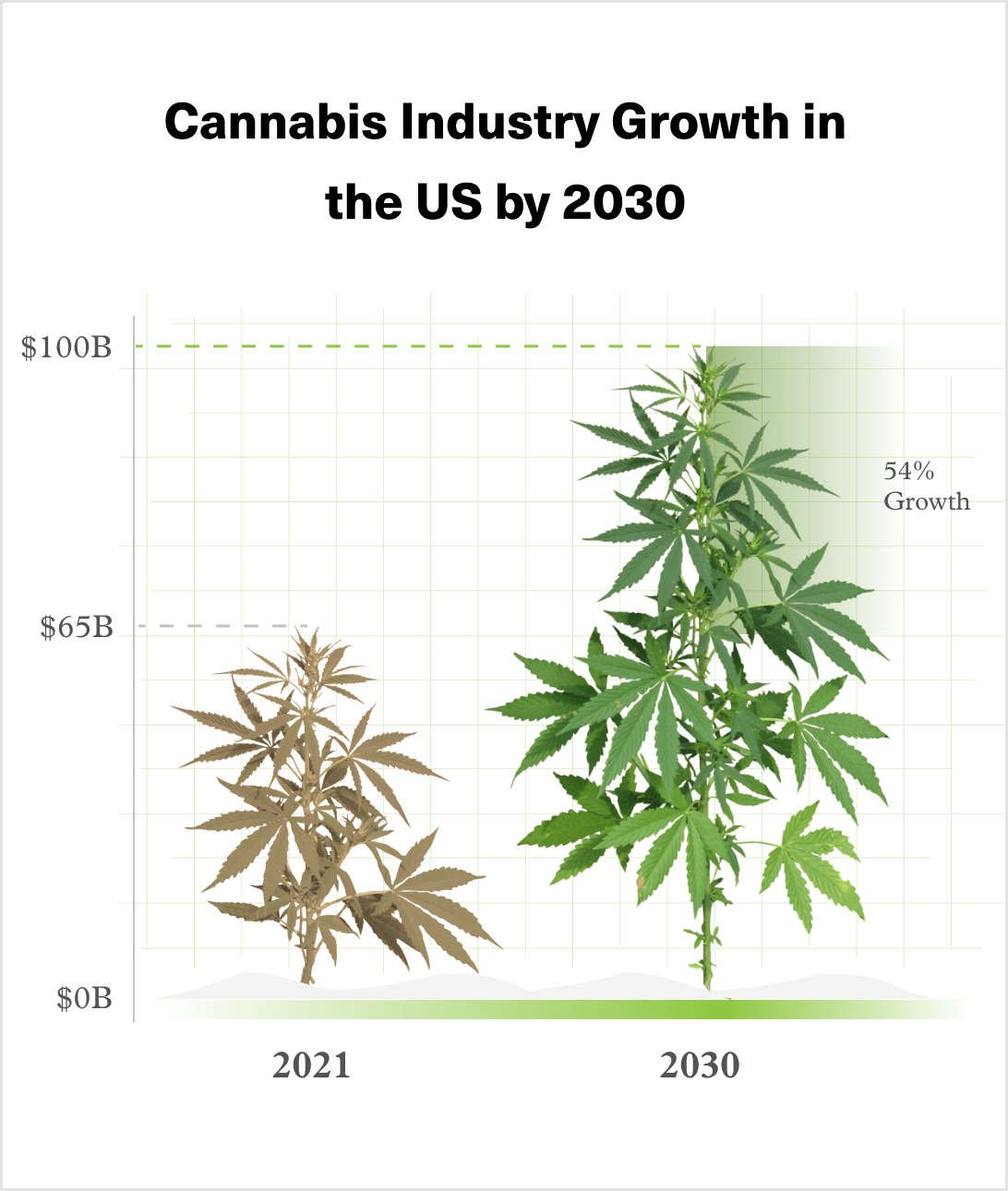

Market Trends in the Cannabis Industry

The 2021 US cannabis industry is valued at $65 billion dollars. By 2030, that value is expected to reach $100 billion1.

This growth is fueled by both increased acceptance of cannabis for health uses and recognition by local and state governments as to the amount of additional tax revenue the industry can provide. In fact, during the 2020 election, every cannabis-related ballot measure passed in both medical and recreational markets2. While it’s still illegal at the federal level (keeping some squeamish investors from entering the market), the list of states allowing for some form of hemp or cannabis use continues to increase.

Additionally, a 2019 Gallup poll survey found that 68% of US adults now support the legalization of marijuana, a record high level (pardon our pun)3. The market will undoubtedly continue to benefit as awareness grows, the perception of cannabis continues to improve, and legality within the marketplace increases.

Getting In On Green Zoned Properties

A green zone is an isolated area that permits the establishment of businesses that supply cannabis and its related products. These zones are determined according to state law. The National Association of Realtors (NAR) has identified that there are a limited number of green zoned properties across the US, further driving the demand for and value of the land.

Within this alternative investment option, there are three primary avenues you can take when dealing with green zoned properties:

Each of these options carries different benefits, returns, and challenges. Before we explore the strategy behind each of these alternative real estate investments, we need to be clear on your goals.

Identifying Your Real Estate Investment Goals

There are three things that seem to surprise investors about getting into the cannabis industry:

To say the cannabis industry is complex and nuanced is an understatement. With that, though, comes a wide array of investment vehicles at various stages of the supply chain. The best way to identify how to invest comes first from becoming abundantly clear on what your investment goals are:

With those five answers, you can make an informed dive into the vast amount of alternative investment vehicles available within the cannabis industry and weigh which option or options best meet these goals.

Angle #1: Buying and Selling Green Zoned Real Estate for a Relatively Fast ROI

If you identify as a “treasure hunter” amongst investors, willing to dig to uncover the next hot spot, buying and selling green zoned real estate is right up your alley. This “flip” mentality of real estate investing gives you a few key advantages:

To be successful in buying and selling green zoned real estate, one of the most important things you can do is stay abreast of upcoming cannabis proposals at the local level. Doing so may allow you to preemptively identify properties that have recently become or are anticipated to become green zoned.

If you’re struggling to identify properties, BeGreenLegal offers a Property Search and Compatibility package. Our team of GIS experts, biologists, consultants, and licensed real estate agents provide a well-rounded and thorough assessment of properties to identify those that best meet your investment criteria. We’ll perform an opportunity analysis, city and county compatibility review, and parcel analysis before finally assisting you with the acquisition of the property.

Suppose you’ve already found a property or properties. In that case, we can perform a Property Suitability Analysis to help you to identify if the real estate purchase you’re considering is a wise investment based on a variety of factors including neighborhood compatibility and environmental factors.

Angle #2: Buying, Developing, and Selling Green Zoned Real Estate for Larger, Longer Term ROI

This type of alternate real estate investment vehicle is best suited for the investor who has a strong interest in the cannabis industry, a willingness to take on higher risk for a more sizable return, and the tenacity and patience to work through the government approval process. These investors looking to buy, develop, and sell are interested in a more significant ROI, without holding equity long term or being a partner.

One of the most prominent misconceptions investors have when it comes to a green zoned property is that it carries with it carte blanche for any cannabis business operation you want to have. The reality is that a green zoned property may only be granted approval for one of the several stages of the cannabis supply chain:

While each stage of development adds value, going through the process of discovering and entitling a properly zoned land with a Conditional Use Permit (CUP) increases the value of the property by approximately 25%. The process (which may take a year) involves ensuring your property and its intended use are compatible with the surrounding zoning designations. Putting in the additional development work to receive a state license may increase the value of your land by another $100k to $300k, depending on local scarcity and marketability. Developing a property to where it is operable as a profitable cannabis business will get you the greatest return.

Through careful research or by employing a service like BeGreenLegal’s Property Suitability Analysis, you may be able to determine if further development of the property is possible to enhance its value before you sell. If it is, you may have struck gold…or rather green.

These types of investments do carry more risk for a few reasons. They are a longer-term investment due to the timing and nature of receiving government zoning approvals. In some counties and townships, the window for approval may only be 1-3 months of the year and can come with very little notice. Missing this window could mean waiting almost another full year to attempt obtaining the permit.

Additionally, the longer you hold a green zoned property, the more necessary it becomes to stay on top of regulatory changes. Such changes could mean that your property is suddenly identified as part of a burrowing owl habitat and must be reconfigured. There are cultivators who have not properly vetted their land and have been faced with the unenviable (and fund-draining) task of having to relocate their marijuana cultivation by an entire acre because it is too close to a waterway. Careful analysis and monitoring of the regulatory environment through services like our Compliance Analysis can help mitigate these risks.

The greater the opportunities are for a property to be vertically integrated within the cannabis industry, the more the value of that property increases, resulting in the exponential growth of your ROI.

Angle #3: Buying, Developing, and Leasing Green Zoned Real Estate for Continual ROI and an Eventual High Valuation Exit

These are for the types of investors drawn to alternative investments like cryptocurrency or non-fungible tokens and plan to hold those investments for the long haul. They’re the visionaries who can spot bourgeoning industries and have the drive to take full advantage of the opportunities available. Buying, developing, and then leasing green zoned real estate takes patience and perseverance; however, the opportunity for financial return is tremendous.

This approach to cannabis real estate investing produced a turn-key operation that will provide multiple residual income opportunities and the greatest increase in value per square foot of your property. It is best suited for an active investor with a strong interest in the cannabis industry, a vision for creating state-of-the-art facilities, and the cash flow to sustain the enterprise while it grows.

In selecting this investment route, investors must additionally plan for:

Consulting with experienced industry experts to stay abreast of current regulations and future opportunities for growth will help you achieve the most consistent growth. BeGreenLegal’s Post License Services are here to support investors who are looking to enter the cannabis game for the long (and profitable) haul.

Additional Opportunities for Investment

Investing in and developing cannabis real estate is just the tip of the marijuana leaf. There are many other opportunities within the industry to invest and grow.

Knowing your goals and having a thorough analysis of the market is the best way to determine where you fit within the many facets of the cannabis investment market.

While it may seem like everybody is buzzing about cannabis nowadays, the current market is still relatively undersaturated and with only a few key players in a handful of states across the US. The cannabis industry requires a particular type of investor willing to take a well-informed risk for an exceptionally profitable return. Within a decade, you may be recounting stories to your friends like the investors who bought Bitcoin when it was below $100.

With 11 years of experience BeGreenLegal can help your cannabis businesses launch, grow, and ultimately scale. With outside industry experience in land planning, permitting, and license compliance, we bring a valuable skill set to an industry full of regulations around where and how businesses can operate.

Visit our Investor Services Page to learn more about the many ways that we can support you in your cannabis real estate investment goals.